41 retirement saving contribution credit

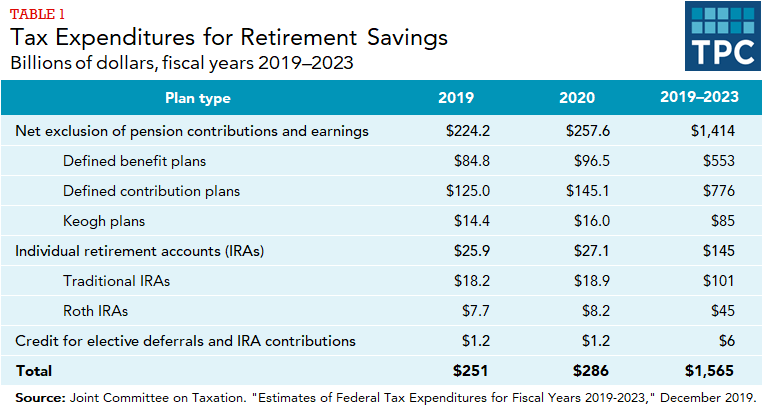

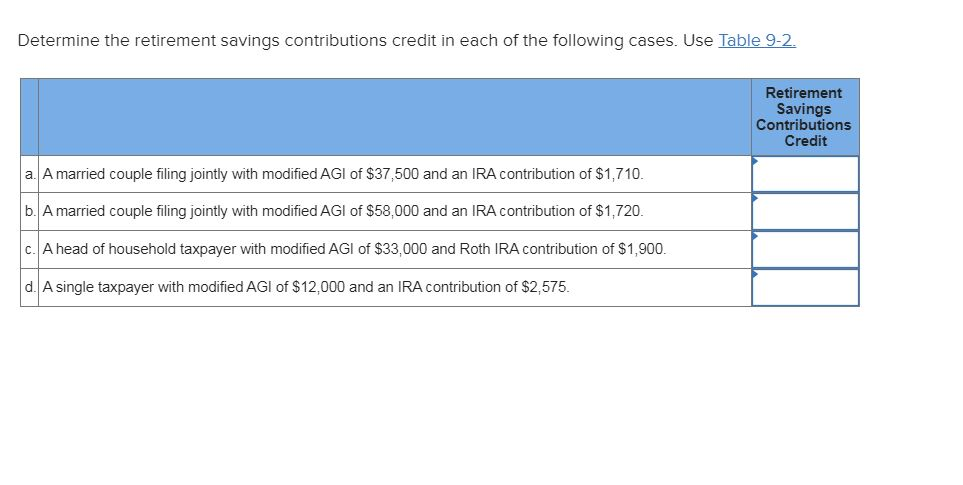

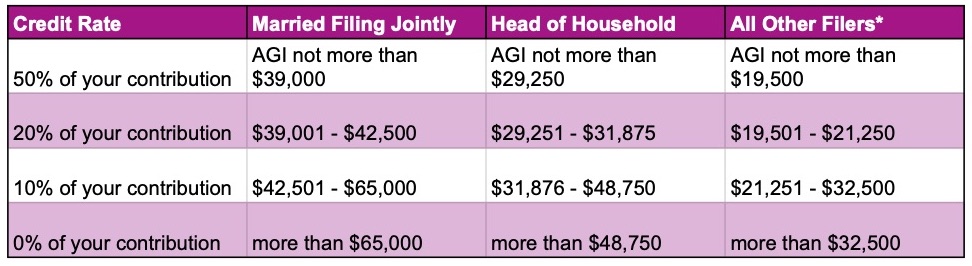

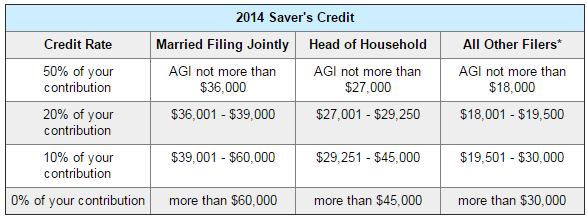

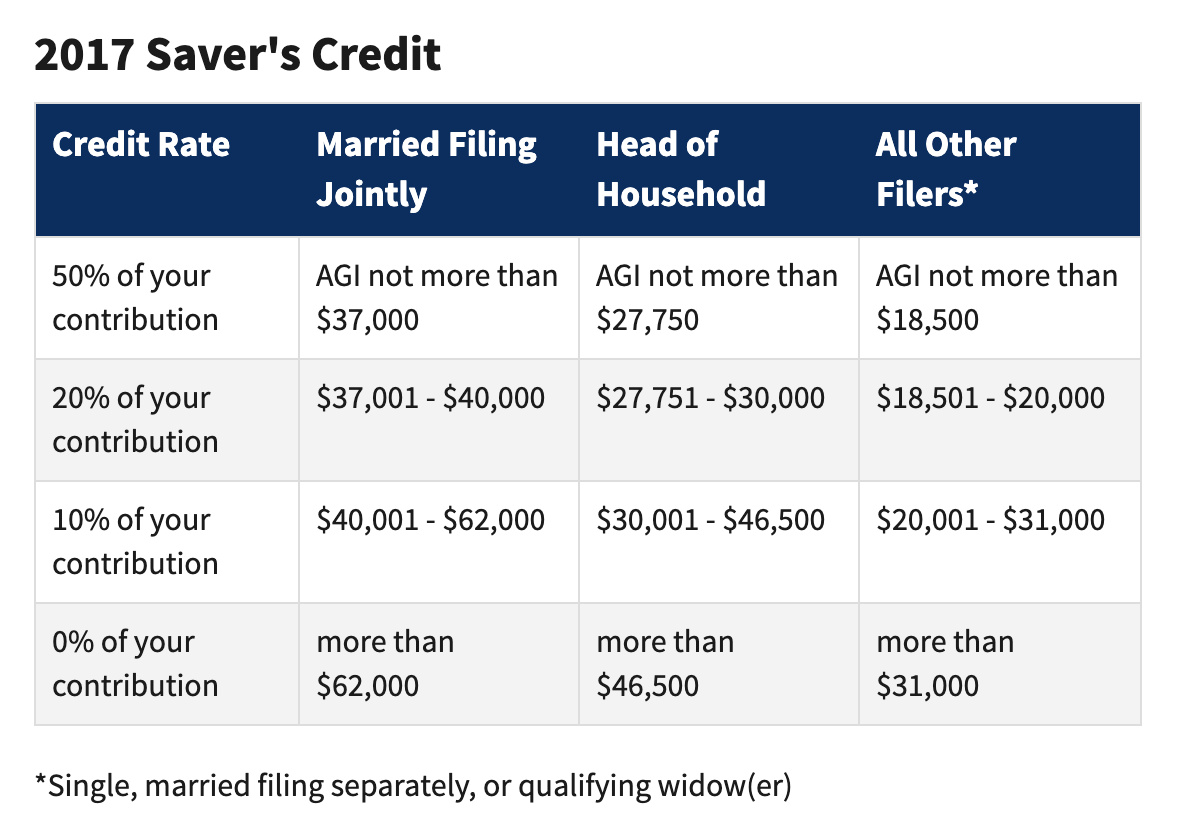

Saver's Credit for 401(k) Plan Contributions Also known as the retirement savings contribution credit, the Savers Credit encourages lower-income employees to save for retirement by giving them a tax credit based on a percentage of their contribution. It can apply to 401(k) plans, IRAs, and other retirement plans. Everything You Need To Know About the Retirement Saver's Credit The Retirement Savings Contributions Credit or Saver's Credit is an incentive that's designed specifically for low- and moderate-income taxpayers. The tax credit is 50%, 20%, or 10% of your retirement contributions for the year, and the percentage depends on your adjusted gross income.

› retirement-savingsThe Retirement Savings Contribution Tax Credit Feb 16, 2022 · The Retirement Savings Contributions Credit is a federal income tax credit designed to encourage low- and modest-income individuals to save for retirement. Sometimes referred to as the "Saver's Credit," the credit equals 10% to 50% of your contributions for the year, up to certain limits.

Retirement saving contribution credit

How This Tax Credit for Retirement Investing Can Save You Up to... By claiming the Retirement Savings Contributions Credit (Saver's Credit), you can get a percentage of your contributions toward eligible retirement savings accounts back when you file your federal tax return. Retirement Savings Contribution Credit - Fairmark.com Retirement Savings Contribution Credit. By Kaye A. Thomas Current as of January 14, 2021. Details on a credit some taxpayers can claim when they contribute to People with low to moderate income find it hard to save for retirement, so there's a special tax credit designed to help this particular group. Retirement Savings Contribution Credits | Human Interest Saver's Credit: The Bottom Line. Retirement Savings Contribution Credits. Your credit can be 10%, 20%, or 50% of your retirement contributions up to that cap, which represents significant savings on your federal taxes and can help you prepare for the costs of retirement when Social...

Retirement saving contribution credit. money.usnews.com › money › retirementNew 401(k) Contribution Limits for 2022 | 401ks | US News Nov 15, 2021 · Retirement savers are eligible to put $1,000 more in a 401(k) plan next year. The 401(k) contribution limit will increase to $20,500 in 2022. Some of the income limits for 401(k) plans will also ... Who Can Claim the Retirement Savings Contribution Credit? Who Can Take the Retirement Savings Contribution Credit? In other words, you can't qualify for the Retirement Savings Contribution Credit if your parents still claim you as a dependent - or your spouse does. 2021-2022 Retirement Contribution Limits - SmartAsset Catch-Up Contribution Limits. In terms of saving for retirement, you're better off starting sooner rather than later. As an incentive to get more people to save for retirement, the IRS offers a special credit for people who make below a certain amount and contribute to an employer's plan or IRA. What is the Retirement Savings Contributions Credit? The Retirement Savings Contribution Credit (aka the "Saver's Credit") is a tax credit that the IRS offers to incentivize low and moderate income taxpayers to make retirement contributions to an eligible retirement account (e.g. IRA, 401K, 403B, 457B...

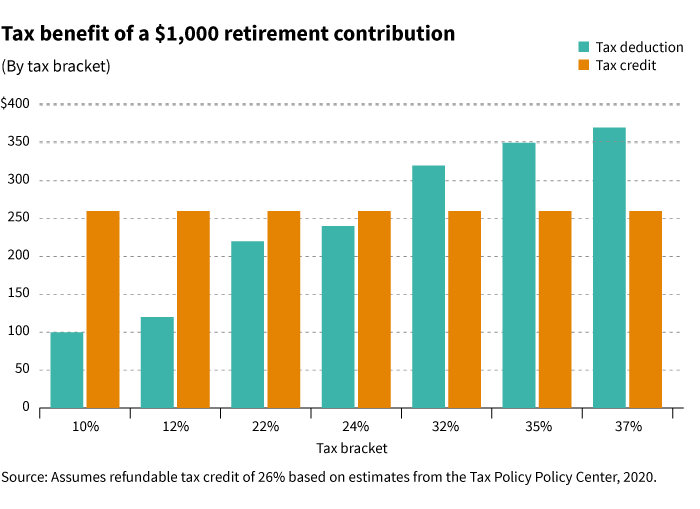

IRS Retirement Savings Contributions Credit — 2021 Saver's Credit The Saver's Credit is based on contributions to a qualified retirement plan, including a traditional or Roth IRA, 401(k), 403(b), 457(b), SIMPLE plan, SARSEP, 501(c)(18)(D) plan, and contributions made to an ABLE account for which you are the designated beneficiary. Retirement savings contribution credits and more: How Congress... Another provision would encourage employers to contribute matching funds for workers who can't afford to save for retirement because they're paying off student loans. Notably, the credit would be made refundable, meaning it could be taken even by people who don't have an income-tax liability. Save for Retirement Through the Saver's Credit | H&R Block The Retirement Savings Contributions Credit or "Saver's Credit" allows you to save money for your retirement, while also offering a tax credit, thus reducing - or in some cases even eliminating - your overall tax amount owed. Retirement Savings Options | Navy Federal Credit Union Explore retirement savings accounts from Navy Federal. Learn how members can grow their savings through a variety of retirement accounts and plans. Retirement Savings Options. Secure Your Future. Our retirement plans can help you reach your goals. New to Saving? Earn a $50 bonus when...

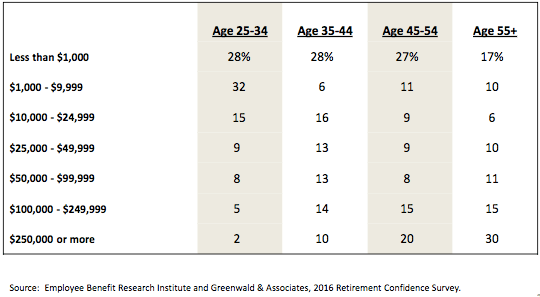

› articles › investingWhy Saving 10% Won’t Get You Through Retirement Nov 19, 2021 · Saving 10% of your salary per year for retirement doesn’t take into account that younger workers earn less than older ones. 401(k) accounts offer considerably higher annual contribution limits ... Retirement Savings Contribution Credit (Saver's Credit) Example: How Larger Retirement Contributions Can Greatly Increase Tax Savings. Although the saver's credit is limited to 50% of a $2000 contribution, the following example shows how a higher contribution can, nonetheless, significantly increase the allowable credit by decreasing AGI. Saver's Tax Credit for Contributions to Retirement Savings The Saver's Credit, also known as the Credit for Qualified Retirement Savings Contributions, was designed to help lower to middle income ranges: the lower the income, the Saver's Credit example: A single taxpayers who made $18,000 in 2021 contributed exactly $4,000 to their retirement account. › retirementRetirement Resources | Bankrate.com Make your retirement plan solid with tips, advice and tools on individual retirement accounts, 401k plans and more.

IRS Raises 2022 Retirement Plan Contribution Limits - Forbes Advisor Those saving in individual retirement accounts (IRAs) unfortunately won't get higher limits. The 2022 annual contribution limit for IRAs remains at $6 This number is actually much more important to the bottom lines of almost all retirees because relatively few people actually contribute the maximum to...

Savers Credit | Retirement Savings Contributions Credit - YouTube Savers Credit or the Retirement Savings Contributions Credit can help you save for your future and reduce your overall tax liability. Here is how it works...

› investing › 2022/01/20This Is Your Biggest Enemy When Saving for Retirement | The ... Jan 20, 2022 · Credit Cards. Best Credit Cards; ... Monthly Contribution Annual Interest Rate ... $500: 10%: $986,964: Data Source: Calculations by author While any amount of saving for retirement is a good ...

Contribute to a Saver's Credit Qualifying Retirement Account This retirement savings contributions credit can be claimed in addition to any tax deduction you earn by contributing to a traditional retirement account. Individuals with an adjusted gross income of up to $34,000 in 2022 could qualify for the saver's credit if they contribute to a retirement account.

Saver's Credit - Get It Back | Individual Retirement Accounts Individual Retirement Accounts. Contributions to both traditional and Roth IRAs are eligible for the Saver's Tax Credit. Workers that can deduct IRA contributions can do so and Voluntary after-tax contributions to a qualified retirement plan or 403(b) annuity also qualify for the Saver's Tax Credit.

Saver's Tax Credit: Everything You Need To Know About... | Bankrate "The saver's credit is an often-overlooked tax credit that can significantly reduce your tax bill while you save for retirement," says Debbie Todd, CPA, and CEO of iCompass Compliance Solutions. Eligible taxpayers can claim the credit in addition to the tax deduction for contributing to a...

The Saver's Credit, formerly known as the Retirement Plan... Long-term savers can capitalize on a little-known tax credit that cuts their IRS bill, even as they add to retirement savings. Too good to be true? The credit value depends on the amount of retirement plan contributions used to calculate any tax savings.

Retirement Savings Contributions Credit... | TaxConnections Retirement Savings Contributions Credit (Saver's Credit). Written by IRS | Posted in IRS Announcement. The amount of the credit is 50%, 20% or 10% of your retirement plan or IRA or ABLE account contributions depending on your adjusted gross income (reported on your Form 1040...

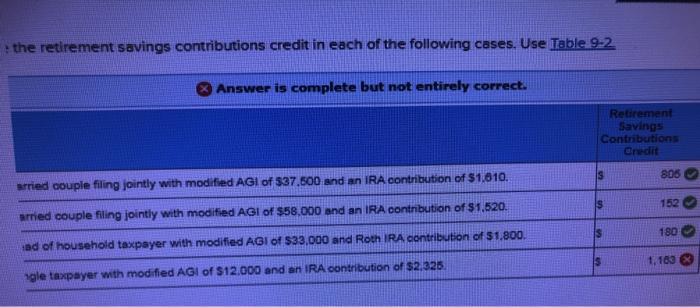

Retirement Savings Contributions Credit: Am I interpreting this... We already contributed $2300 in a Roth IRA in 2019, so that's a credit of $460. Is that really correct? Furthermore, should we dump some more money into our IRAs Running some scenarios based on your figures in turbotax, I show a maximum Retirement Savings Contributions Credit of about $1400.

Retirement Savings Contributions Savers Credit | Internal Revenue... The Saver's Credit is a tax credit for eligible contributions to your IRA, employer-sponsored retirement plan or Achieving a Better Life Experience voluntary after-tax employee contributions made to a qualified retirement plan (including the federal Thrift Savings Plan) or 403(b) plan

Credit Karma Guide to Saving for Retirement | Credit Karma Saving for retirement is complex, but that doesn't mean you can't figure it out. Learn the fundamentals, including what accounts are available and how Keep in mind that not all companies offer matching on employee retirement savings contributions. Ask your HR representative if it's available at your work...

Qualified Retirement Savings Contribution Credit Definition ...Savings Contribution Credit, often abbreviated as the "saver's credit," encourages low-income individuals to contribute to their qualified retirement Taxpayers use IRS Form 8880 for the Qualified Retirement Savings Contribution Credit. As of 2021, the credit is available to single taxpayers with...

› articles › personal-financeIRA vs. Life Insurance for Retirement Saving: What's the ... Jan 19, 2022 · IRA vs. Life Insurance for Retirement Saving: An Overview When saving for retirement, a 401(k) plan is a great place to start, especially if your employer matches a portion of your contribution.

Saver's Credit: What It Is & How It Works in 2021-2022 - NerdWallet The retirement savings contribution credit — the "saver's credit" for short — is a tax credit worth up to $1,000 ($2,000 if married filing jointly) for mid- and low-income taxpayers who contribute to a retirement account.

Saver's Credit: How To Get Free Money To Save for Retirement In 2001, Congress passed the Retirement Savings Contributions Credit (Saver's Credit). The measure is designed to help savers who make a decent living but not a huge income. If you stash cash in your workplace retirement account, IRA or Achieving a Better Life Experience (ABLE) plan, the...

Registered Retirement Savings Plan (RRSP) - RBC Royal Bank Tax-Free Savings - TFSA. Retirement Savings - RRSP. Education Savings - RESP. Guaranteed Investment Certificate - GICs. By December 31 of the year you turn 71, you must stop contributing to your RRSP and convert it to an income option such as a Registered Retirement Income Fund...

What is the 2021 Saver's Credit? The Retirement Savings Contributions Credit (Saver's Credit) helps low and middle-income taxpayers save for retirement. Sometimes this is called the Credit for Qualified Retirement Savings Contribution or Retirement Credit.

Registered retirement savings plan - Wikipedia A registered retirement savings plan (RRSP) (French: régime enregistré d'épargne-retraite, REER), or retirement savings plan (RSP), is a type of financial account in Canada for holding savings and investment assets.

savingmatters.dol.gov › employeesFor Workers - Retirement Savings Education Campaign - Saving ... If your employer offers a defined contribution retirement plan, like a 401(k) plan, you may have to make the decision to participate. As part of that decision, you choose how much to have deducted from your paycheck. Some employers have automatic enrollment 401(k) plans so that you are automatically signed up for the plan unless you opt out.

Retirement Savings Contribution Credits | Human Interest Saver's Credit: The Bottom Line. Retirement Savings Contribution Credits. Your credit can be 10%, 20%, or 50% of your retirement contributions up to that cap, which represents significant savings on your federal taxes and can help you prepare for the costs of retirement when Social...

Retirement Savings Contribution Credit - Fairmark.com Retirement Savings Contribution Credit. By Kaye A. Thomas Current as of January 14, 2021. Details on a credit some taxpayers can claim when they contribute to People with low to moderate income find it hard to save for retirement, so there's a special tax credit designed to help this particular group.

How This Tax Credit for Retirement Investing Can Save You Up to... By claiming the Retirement Savings Contributions Credit (Saver's Credit), you can get a percentage of your contributions toward eligible retirement savings accounts back when you file your federal tax return.

0 Response to "41 retirement saving contribution credit"

Post a Comment